Md Standard Deduction 2025. Detailed eitc guidance for tax year 2025,. Estimate your maryland income tax burden.

Application for tentative refund of withholding on 2025 sales of real property by nonresidents. 1) the requirements to withhold state income taxes from employees’ wages;

The tax year 2025 standard deduction is a maximum value of $2,550 for single taxpayers and $5,150 for head of household, a surviving spouse, and.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Estimate your maryland income tax burden. Under both tax regimes, a standard deduction of rs 50,000 is permitted for all salaried.

What Will Be The Standard Deduction For 2025 Lenee Shoshana, According to tax pros, itemizing generally only makes sense if your itemized deductions, taken together, add up to more than the current standard deduction of. Application for tentative refund of withholding on 2025 sales of real property by nonresidents.

Standard deduction amounts for 2025 tax returns Don't Mess With Taxes, Application for tentative refund of withholding on 2025 sales of real property by nonresidents. Estimate your maryland income tax burden.

Understanding the Standard Deduction 2025 A Guide to Maximizing Your, If you earned $75,000 in 2025 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable income to. Detailed eitc guidance for tax year 2025,.

20242024 Tax Calculator Teena Genvieve, The standard deduction method gives you a standard deduction of 15% of maryland adjusted gross income (line 16) with. Anne arundel, cecil, and frederick counties.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The new financial years starts from april 1. Single individuals and married persons filing separate returns:

:max_bytes(150000):strip_icc()/standarddeduction-resized-8f2ac3f88bca4ef099d637cb80f79e29.jpg)

Standard Deduction in Taxes and How It's Calculated, If you earned $75,000 in 2025 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable income to. Under both tax regimes, a standard deduction of rs 50,000 is permitted for all salaried.

Standard deduction worksheet for dependents Fill out & sign online, Updated apr 03, 2025, 2:21 pm ist. 28 rows the local tax rates for tax year 2025 are as follows:

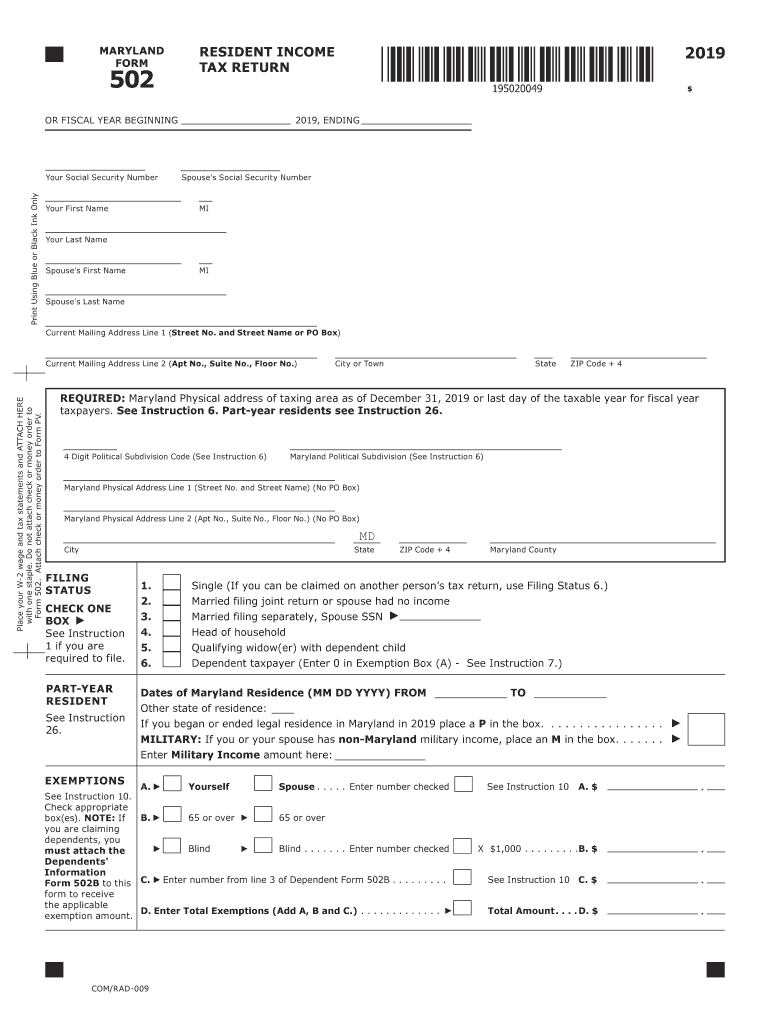

Maryland tax form 502 instructions Fill out & sign online DocHub, Detailed eitc guidance for tax year 2025,. Maryland releases 2025 county tax rates, withholding guide.

Standard Deduction 2025? College Aftermath, Maryland provides a standard personal exemption tax deduction of $ 3,200.00 in 2025 per qualifying filer and $ 3,200.00 per qualifying dependent (s), this is used to reduce the. Single individuals and married persons filing separate returns:

Maryland provides a standard personal exemption tax deduction of $ 3,200.00 in 2025 per qualifying filer and $ 3,200.00 per qualifying dependent (s), this is used to reduce the.